All Categories

Featured

Table of Contents

That generally makes them a more inexpensive option forever insurance coverage. Some term policies may not keep the premium and survivor benefit the very same in time. You do not wish to mistakenly assume you're getting level term coverage and after that have your survivor benefit modification later. Lots of people obtain life insurance protection to aid financially safeguard their enjoyed ones in instance of their unexpected fatality.

Or you might have the alternative to transform your existing term protection right into a permanent plan that lasts the remainder of your life. Various life insurance policy plans have potential benefits and disadvantages, so it's crucial to recognize each before you choose to buy a policy.

As long as you pay the premium, your recipients will get the survivor benefit if you pass away while covered. That said, it's vital to note that most policies are contestable for 2 years which indicates insurance coverage might be rescinded on fatality, should a misrepresentation be discovered in the app. Plans that are not contestable often have a graded survivor benefit.

Costs are usually lower than whole life policies. You're not secured into an agreement for the rest of your life.

And you can not pay out your plan during its term, so you will not obtain any kind of monetary advantage from your past protection. As with various other kinds of life insurance, the cost of a level term policy relies on your age, insurance coverage requirements, work, way of living and wellness. Commonly, you'll discover more economical coverage if you're younger, healthier and less high-risk to guarantee.

Renowned Term Vs Universal Life Insurance

Since degree term premiums stay the same throughout of coverage, you'll understand specifically just how much you'll pay each time. That can be a large assistance when budgeting your expenses. Degree term protection likewise has some versatility, enabling you to tailor your plan with additional functions. These usually come in the kind of cyclists.

You may have to satisfy specific problems and qualifications for your insurance provider to establish this rider. There also could be an age or time limitation on the coverage.

The survivor benefit is typically smaller, and coverage generally lasts till your youngster transforms 18 or 25. This cyclist may be a much more affordable method to aid ensure your children are covered as bikers can frequently cover several dependents simultaneously. As soon as your kid ages out of this insurance coverage, it might be possible to transform the rider right into a brand-new policy.

The most typical kind of long-term life insurance is entire life insurance, however it has some key differences contrasted to degree term insurance coverage. Here's a fundamental introduction of what to think about when comparing term vs.

Value What Is Decreasing Term Life Insurance

Whole life entire lasts insurance policy life, while term coverage lasts protection a specific periodCertain The premiums for term life insurance coverage are commonly lower than whole life protection.

One of the primary functions of level term insurance coverage is that your costs and your death benefit do not alter. You may have protection that starts with a fatality benefit of $10,000, which can cover a mortgage, and after that each year, the fatality advantage will decrease by a set quantity or percentage.

Because of this, it's commonly a much more budget friendly sort of degree term coverage. You might have life insurance policy via your company, but it may not be adequate life insurance policy for your needs. The primary step when getting a plan is establishing just how much life insurance policy you require. Consider aspects such as: Age Family size and ages Employment status Earnings Financial debt Way of life Expected final costs A life insurance policy calculator can help establish exactly how much you require to begin.

After making a decision on a policy, complete the application. If you're accepted, sign the documentation and pay your very first costs.

Decreasing Term Life Insurance Is Often Used To

You might desire to update your beneficiary information if you have actually had any substantial life modifications, such as a marriage, birth or divorce. Life insurance can sometimes feel difficult.

No, degree term life insurance policy does not have cash worth. Some life insurance policies have a financial investment function that permits you to construct money value in time. A section of your costs payments is established aside and can earn rate of interest in time, which grows tax-deferred throughout the life of your protection.

These plans are frequently considerably extra costly than term insurance coverage. If you get to the end of your plan and are still alive, the coverage ends. However, you have some options if you still want some life insurance policy coverage. You can: If you're 65 and your insurance coverage has gone out, for example, you might intend to buy a new 10-year level term life insurance policy plan.

Premium A Renewable Term Life Insurance Policy Can Be Renewed

You may have the ability to convert your term insurance coverage right into an entire life plan that will last for the rest of your life. Numerous sorts of level term plans are convertible. That suggests, at the end of your insurance coverage, you can convert some or every one of your plan to whole life insurance coverage.

Level term life insurance policy is a plan that lasts a collection term usually between 10 and 30 years and comes with a degree survivor benefit and level costs that stay the very same for the whole time the plan is in impact. This implies you'll understand exactly just how much your repayments are and when you'll have to make them, permitting you to budget accordingly.

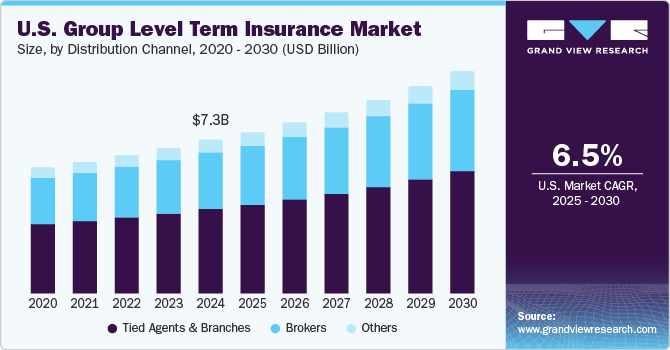

Degree term can be a great alternative if you're wanting to get life insurance policy protection for the initial time. According to LIMRA's 2023 Insurance Barometer Research Study, 30% of all grownups in the U.S. demand life insurance policy and do not have any kind of policy. Degree term life is foreseeable and budget friendly, which makes it one of the most preferred types of life insurance policy.

Table of Contents

Latest Posts

Affordable Funeral Insurance

Final Expense Project

1 Life Funeral Plan

More

Latest Posts

Affordable Funeral Insurance

Final Expense Project

1 Life Funeral Plan